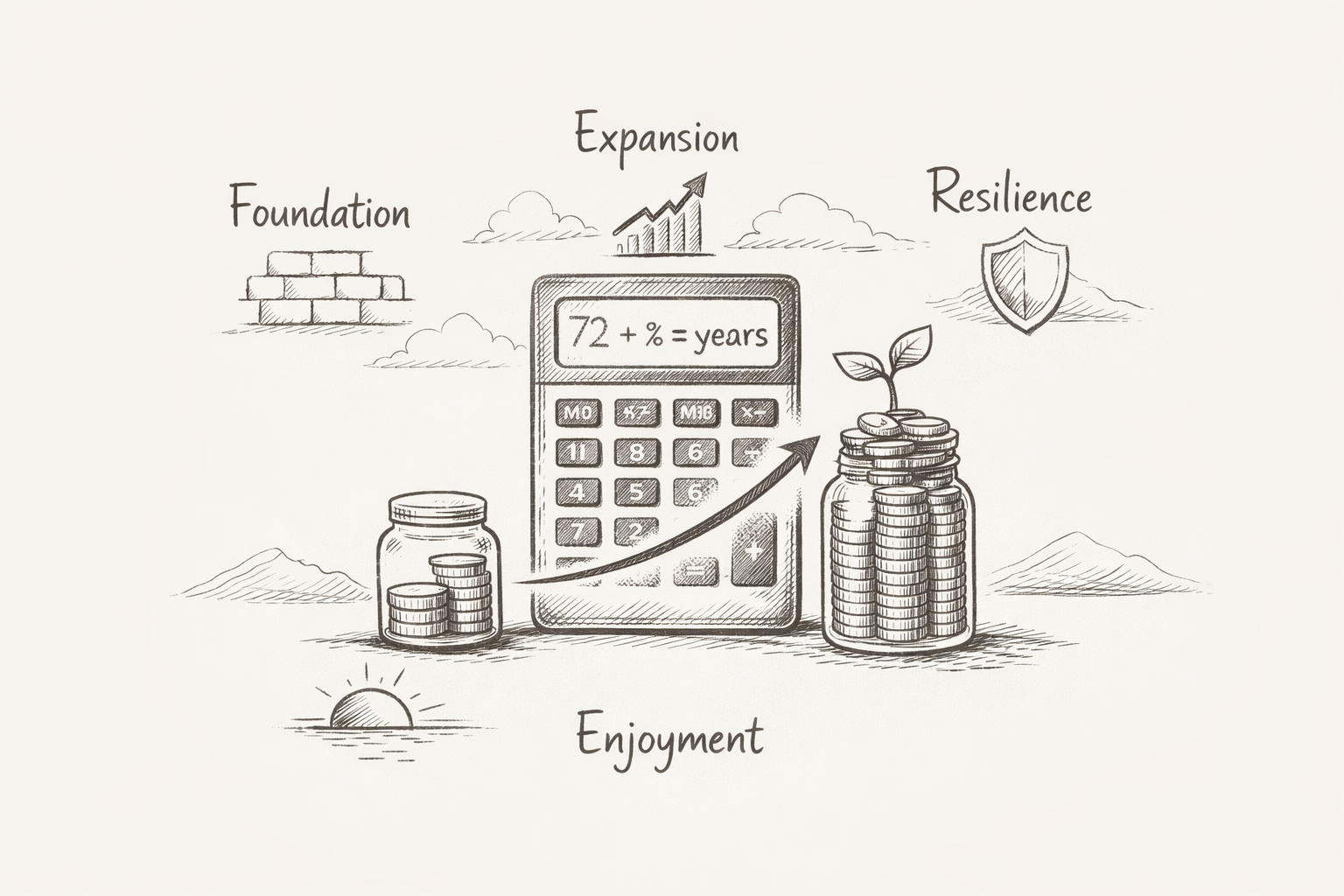

Double Your Money: A Simple Formula That Fits the FREE Framework

f you are already exploring the FREE Framework, you will know this already: financial freedom is not about chasing shortcuts or extreme risk. It is about building clarity, stability, and momentum over time.

So when people talk about “doubling your money,” the real question is not whether it is possible. It is whether it can be done calmly, deliberately, and in alignment with the life you are trying to build.

The answer is yes. But only if you understand what actually drives money growth and how it fits within a broader financial system.

Is It Really Possible to Double Your Money Without Taking Big Risks?

Doubling your money often sounds like marketing language. It gets lumped in with speculation, hype, or stories that only apply to people who started with large sums or perfect timing.

In reality, doubling your money is simply the natural outcome of time plus a sufficient rate of return, applied consistently. There is no trick. There is no secret strategy reserved for professionals.

What does matter is:

Where your money is positioned

How long it stays invested

Whether risk is managed intentionally rather than ignored

Once those pieces are understood, doubling money stops feeling dramatic and starts feeling inevitable.

Why Growing Your Money Matters More Than Saving Harder

Most people focus heavily on saving, which is a sensible starting point. Saving builds stability, breathing room, and optionality. Within the FREE Framework, this sits firmly in Foundation.

However, savings alone do not create freedom.

The reason is inflation. Even at modest levels, inflation quietly erodes purchasing power over time. Money that feels “safe” in cash can actually become less useful year after year.

This is where Resilience comes in. Resilience is not about taking more risk. It is about avoiding silent risks, including the risk of stagnation.

Growing your money is not about greed. It is about ensuring that the effort you put into earning money continues to support your future self.

The Rule of 72 Explained Simply

A useful mental model for understanding money growth is the Rule of 72.

The rule works like this:

72 divided by your annual return equals the approximate number of years it takes to double your money.

Examples:

At 4 percent annual growth, money doubles in roughly 18 years

At 8 percent, it doubles in about 9 years

At 12 percent, it doubles in roughly 6 years

This is not about precision. It is about intuition. The rule helps you feel the impact of small changes in return and time.

Within the FREE Framework, this sits squarely in Expansion. Expansion is not about aggressive bets. It is about positioning capital where growth is mathematically plausible and behaviourally sustainable.

Why “Safe” Savings Can Quietly Work Against You

Keeping money in cash feels responsible. It removes volatility and uncertainty. That is valuable, especially early on.

But there is a point where excessive caution becomes a liability.

Low-interest savings accounts:

Protect nominal value

Grow extremely slowly

Often fail to keep pace with inflation

Over long periods, this creates a hidden loss. Your balance may rise, but what that money can do for you shrinks.

Resilience is not the absence of risk. It is the intentional selection of risks you are willing to live with. For most people, accepting modest, controlled investment risk is safer than guaranteeing long-term stagnation.

Realistic Ways People Actually Double Their Money

There are multiple paths to doubling money. None are perfect, and none work in isolation. What matters is fit, time horizon, and consistency.

Property as a Long-Term Growth Engine

Property combines two forces: income and appreciation. Rental cash flow supports holding the asset, while long-term price growth compounds quietly in the background.

Used sensibly, property can double invested capital over a decade or so, particularly when leverage is applied conservatively and locations are chosen carefully.

This approach suits those comfortable with illiquidity and long time horizons.

Markets as Probabilistic Growth Engines

Equity markets have historically delivered mid to high single-digit annual returns over long periods. That may not sound exciting, but compounding turns patience into power.

Diversification, discipline, and time matter more than precision. This is not about predicting markets. It is about participating in them.

For FREE Framework readers, markets sit in Expansion, supported by a solid Foundation and Resilience layer beneath.

Skill-Based and Income Expansion

In some cases, the fastest way to double money is not through markets at all. It is through increasing earning power.

Skills, side projects, and small ventures offer something investments cannot: control. They also require effort, energy, and focus, which must be weighed honestly.

This path works best when it complements, rather than replaces, a broader financial system.

What Matters More Than the Method: Time, Behaviour, and Consistency

Across all approaches, the same drivers appear again and again:

Time in the system

Behaviour under uncertainty

Consistent decision-making

Doubling money rarely comes from a single decision. It comes from staying aligned long enough for compounding to do its work.

This is where Enjoyment enters the picture. Financial growth should reduce stress, not increase it. If a strategy keeps you awake at night or dominates your attention, it is misaligned, no matter how attractive it looks on paper.

Key Takeaways for The Secret to Doubling Your Money

Doubling your money is a mathematical outcome, not a fantasy

Saving alone builds stability but not freedom

The Rule of 72 helps you understand time and return intuitively

Resilience includes avoiding the risk of stagnation

Expansion works best when layered on a solid Foundation

The right strategy is one you can sustain calmly over time